Introduction: From an abstract concept to a new technological field

Blockchain is not a single technology. After having been conceived by Bitcoin creator — Satoshi Nakamoto, the world discovered the first known representation of this abstract concept through Bitcoin. Since then, hundreds of implementations have been explored. These are also called Distributed Ledger Technologies.

With hindsight, the blockchain concept is quite simple: it proposes an innovative information system architecture to process value exchange within open ecosystems. On the traditional web, information can be corrupted. Blockchain aims at securing high-sensitive data exchanges to preserve them from wrongdoing.

From this perspective, this innovation seems relatively accessible. But as a fundamental technological layer, there is numerous other implications. To really understand the application scope of this, we also need to consider its upgradeability capacity. As a deep technology, there is several characteristics, parameters and features to consider as changing.

These includes the size of the targeted ecosystem, the way to manage writing and reading rights, the awaited level of safety, the needed performance, as well as other parameters such as backward ability or technological compatibility with existing infrastructures. All these characteristics are intrinsically linked, and compromises must be found for a technological standard to emerge, usually associated with a determined use case. In this way, it seems almost impossible to result in a single standard regarding the large range of applications envisioned.

Blockchain technologies: The clash of different ideological trends

From Bitcoiners to Ethereists: The purist confrontation

All the story began in January 2009 with the Bitcoin birth. At this time, blockchain wasn’t really theorized and was only used to maintain Bitcoin network, originally designed to propose a new digital monetary network. Until 2015, blockchain concept remained silent while Bitcoin gave birth to a few other cryptocurrencies trying to improve its original protocol. Blockchain research efforts began to be funded thanks to the first Bitcoin value increases.

In 2015, a new birth happened in the blockchain ecosystem with the Ethereum project. It has been the first to define the concept of smart contract, and so increased the theoretical used of blockchain technologies. Before this, blockchain was essentially a cyberpunk dream for an alternative financial network — except for Ripple, born in 2012, which is targeting banking sector.

Ethereum platform also introduced the concept of tokens, with the well-known ERC20 standard to generate a fix supply of newborn digital assetsand to manage associated financial transactions. Coupled with a smart contract for the distribution, it has opened the ICOs’ pandora box, with thousands of projects using this mechanism and surfing on the growing blockchain hype to quickly raise huge amount of money, using the promise of a financial gain within their utility token.

In everything that happened from then on, the very large part of blockchain community debates remain about Bitcoin and Ethereum. On one hand, Bitcoiners believe blockchain is only suited to cryptocurrencies. For them, blockchain isn’t efficient enough to support smart contract features. On the other hand, Ethereists envision huge opportunities associated to utility token usage. They promote a post-capitalism economic system using tokens, enabling projects’ crowdfunding as well as added-value distribution thanks to their token-based business model. This promise is attractive first but don’t consider sufficiently the speculative problematic surrounding secondary markets. This made the bubble pumped and burst.

The good part of this speculative bubble has been to fund a large variety of infrastructure projects, amidst the rubble, trying to improve the Ethereum underlying protocol for a similar value proposal. These are projects like Cardano, IOTA, NEO, Tezos or Vechain, to name a few.

With Ripple and EOS: The non-conforming try

In the middle of this, a few projects have been non-compliant to the blockchain ideal. Ripple and EOS are the most controversial ones. They are like the dark side of Bitcoin and Ethereum. Both are often considered as non-blockchain platform because of a low decentralized architecture with some backward features on their network.

Even being highly controversial, these projects hold some interesting promises for traditional actors: to reproduce blockchain network architecture with better performance and the ability to keep the network management in a few hands.

As said before, there isn’t only one solution for blockchain network architecture. This kind of features assembling could address some specific usages, for instance associated to fiat currency tokenization. If a government want to tokenize its own fiat currency to enjoy the programmable money functionality, it has more chance to happen through centralized architecture like these ones.

Platform standards and interoperability: A complex mesh building through private and public networks

With all these different networks developing specific features assembling, blockchain world is currently highly fragmented. And this is without mentioning several private blockchain standards like Hyperledger or Corda dedicated to private companies and consortium. At the end, almost everyone is working on a different implementation following their own needs.

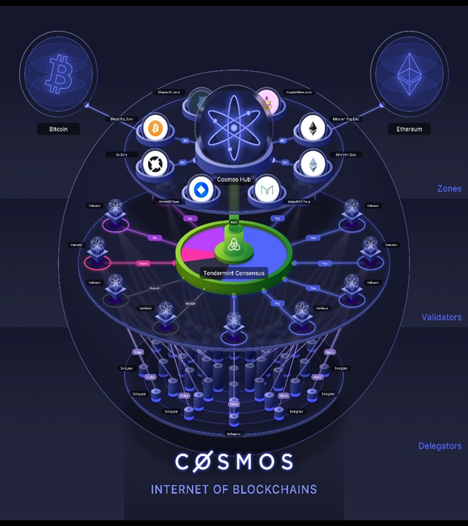

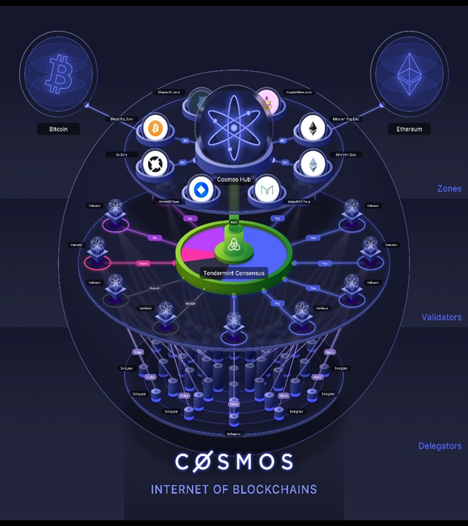

And as everything is going extremely fast in this innovative sector, the next step is already being developed: interoperable blockchain protocols to connect every kind of blockchain standards, thus creating kind of an internet of blockchains. This is happening with projects like Cosmos, Polkadot or Clovyr, all trying to create a new standard for blockchain standard interconnectivity. These need also to consider some evolving proposals for scaling Bitcoin or Ethereum networks, called Lightning or Sharding, which basically consist to create state channels or overlap networks to simplify the transaction validation process while building multilayer infrastructure.

Future blockchain networks will then be an inextricable tangle of standards and multilayer protocols. The challenges lie in finding the better compromise between complexity and usability. It requires time for technological improvement before industrialization.

Blockchain applications: Being pragmatic while brushing aside background noise

On the usage aspect, we have seen everything and its opposite since a few years. It is hard to sorting out the real opportunities from the background noise.

Cryptocurrencies: A first-mover advantage supporting a revolutionary ideology

Cryptocurrencies have been the first blockchain use case supported by the cyberpunk ideal to confront with the traditional financial system. In a way, this is a truly interesting movement as it affects one of the most sensitive sectors of our economy, which is also its foundation.

At this time, this movement seems to be intended to achieve the creation of a new reserve digital asset class. Bitcoin is currently considered as the digital gold, and even with all the controversies on carbon impact or energy efficiency, it appears more than likely to succeed in this way. Underlying protocols will evolve with time, and financial lobbies will likely end up adopting this new asset class.

Public networks: From utility to security tokens, including stable coins

Then come other public blockchain platforms delivering smart contract features through different type of tokens. This concern programmable assets, whether it be currencies or other financial instruments. The programmable aspect means to automate a value transfer according to certain conditions. The value in question can represent many different financial vehicles, from utility to security tokens including stable coins.

This last category will eventually replace many current utility tokens. In most cases, the volatility aspects of tokens will be a strong barrier against products or services adoption. On a given use case, a value proposal involving a stable financial vehicle will likely generate a greater adoption than one based on a utility token. Indeed, the automated value exchange featureis sufficiently innovative by itself. On the other hand, the variable value is also an interesting characteristic to promote some specific behaviors, to create network effects, or to share within a given community the value generated by a dedicated product or service. But for most of current tokens that have been generated through ICOs, speculation is too strong compared to real use, distorting the usability.

Within this being said, public blockchain networks have the ability to digitalize every kind of financial vehicle while enjoying the smart contract features. When considering the industry of the future, smart cities, smart energy grids, or advanced transportation systems, these solutions will help fluidized value exchanges from many intelligent devices and systems. In developing synergies with Artificial Intelligence and Internet of Things, public blockchain network is the interconnectivity piece for many innovations.

Private uses: Raising awareness and generating adoption

For this futurist scenario to happen, blockchain technologies must penetrate most companies and industries. This is the major obstacle to blockchain adoption, regarding the high complexity of the technological concept and its different technical implementations. It requires time to sufficiently mature the infrastructure for professionals to be able to use it without having to master the technical complexity. Looking to the current technological developments, several years will be needed.

In the meantime, corporates can explore this new concept by developing private uses: here come the private blockchain networks. The major difference is related to the data types. On public networks, tokens represent the medium of exchange and mainly are a unit value. On private networks, basic data are often exchanged without using any token. Networks scale are usually several orders of magnitude lower and data transferred could be more complex. In some case, the blockchain label is questionable as actors are sometimes developing basic architecture of shared database. Effectively, it remains innovative for companies that have still a lot to do in their digitalization process. This is a first step before to explore further blockchain uses.

The remaining issue is about finding the relevant use cases, which is also important for any public uses. A relevant use cases usually involve two main aspects: the true need for a distributed information system, and the ability to control edge-effects. When the need to exchange information can be led by a single player, a centralized data base is often more efficient. And if there is no way to check the truthfulness of information before to be recorded within the distributed information system, the problematic remains the same even with a blockchain architecture.

Conclusion: From a cyberpunk promise to the next economic digitalization process

To conclude, blockchain technologies are following a similar development scheme than internet technologies 20 years ago. At these times, Internet was also very controversial before to sustain the advent of a global network. The specificity of this new web comes from its origin. Internet has emerged as a military tool, but blockchain technologies has been created as an anti-capitalism solution. Regardless their origin, the development path remains comparable. Where internet bring us information fluidity, blockchain will liquefy value exchanges.

Irrespective of the technical complexity and the controversial uses, the promise behind blockchain technologies is about bringing digitalization process to the next step by provoking a new digital wave on our economic and financial system. Cryptocurrencies doesn’t have to dictate the future for this to happen. They played their role as a Trojan horse to introduce blockchain in major corporations. They probably won’t succeed in their current shape, but they also could inspire future use cases in the coming token economy.

Blockchain is not a single technology. After having been conceived by Bitcoin creator — Satoshi Nakamoto, the world discovered the first known representation of this abstract concept through Bitcoin. Since then, hundreds of implementations have been explored. These are also called Distributed Ledger Technologies.

With hindsight, the blockchain concept is quite simple: it proposes an innovative information system architecture to process value exchange within open ecosystems. On the traditional web, information can be corrupted. Blockchain aims at securing high-sensitive data exchanges to preserve them from wrongdoing.

From this perspective, this innovation seems relatively accessible. But as a fundamental technological layer, there is numerous other implications. To really understand the application scope of this, we also need to consider its upgradeability capacity. As a deep technology, there is several characteristics, parameters and features to consider as changing.

These includes the size of the targeted ecosystem, the way to manage writing and reading rights, the awaited level of safety, the needed performance, as well as other parameters such as backward ability or technological compatibility with existing infrastructures. All these characteristics are intrinsically linked, and compromises must be found for a technological standard to emerge, usually associated with a determined use case. In this way, it seems almost impossible to result in a single standard regarding the large range of applications envisioned.

Blockchain technologies: The clash of different ideological trends

From Bitcoiners to Ethereists: The purist confrontation

All the story began in January 2009 with the Bitcoin birth. At this time, blockchain wasn’t really theorized and was only used to maintain Bitcoin network, originally designed to propose a new digital monetary network. Until 2015, blockchain concept remained silent while Bitcoin gave birth to a few other cryptocurrencies trying to improve its original protocol. Blockchain research efforts began to be funded thanks to the first Bitcoin value increases.

In 2015, a new birth happened in the blockchain ecosystem with the Ethereum project. It has been the first to define the concept of smart contract, and so increased the theoretical used of blockchain technologies. Before this, blockchain was essentially a cyberpunk dream for an alternative financial network — except for Ripple, born in 2012, which is targeting banking sector.

Ethereum platform also introduced the concept of tokens, with the well-known ERC20 standard to generate a fix supply of newborn digital assetsand to manage associated financial transactions. Coupled with a smart contract for the distribution, it has opened the ICOs’ pandora box, with thousands of projects using this mechanism and surfing on the growing blockchain hype to quickly raise huge amount of money, using the promise of a financial gain within their utility token.

In everything that happened from then on, the very large part of blockchain community debates remain about Bitcoin and Ethereum. On one hand, Bitcoiners believe blockchain is only suited to cryptocurrencies. For them, blockchain isn’t efficient enough to support smart contract features. On the other hand, Ethereists envision huge opportunities associated to utility token usage. They promote a post-capitalism economic system using tokens, enabling projects’ crowdfunding as well as added-value distribution thanks to their token-based business model. This promise is attractive first but don’t consider sufficiently the speculative problematic surrounding secondary markets. This made the bubble pumped and burst.

The good part of this speculative bubble has been to fund a large variety of infrastructure projects, amidst the rubble, trying to improve the Ethereum underlying protocol for a similar value proposal. These are projects like Cardano, IOTA, NEO, Tezos or Vechain, to name a few.

With Ripple and EOS: The non-conforming try

In the middle of this, a few projects have been non-compliant to the blockchain ideal. Ripple and EOS are the most controversial ones. They are like the dark side of Bitcoin and Ethereum. Both are often considered as non-blockchain platform because of a low decentralized architecture with some backward features on their network.

Even being highly controversial, these projects hold some interesting promises for traditional actors: to reproduce blockchain network architecture with better performance and the ability to keep the network management in a few hands.

As said before, there isn’t only one solution for blockchain network architecture. This kind of features assembling could address some specific usages, for instance associated to fiat currency tokenization. If a government want to tokenize its own fiat currency to enjoy the programmable money functionality, it has more chance to happen through centralized architecture like these ones.

Platform standards and interoperability: A complex mesh building through private and public networks

With all these different networks developing specific features assembling, blockchain world is currently highly fragmented. And this is without mentioning several private blockchain standards like Hyperledger or Corda dedicated to private companies and consortium. At the end, almost everyone is working on a different implementation following their own needs.

And as everything is going extremely fast in this innovative sector, the next step is already being developed: interoperable blockchain protocols to connect every kind of blockchain standards, thus creating kind of an internet of blockchains. This is happening with projects like Cosmos, Polkadot or Clovyr, all trying to create a new standard for blockchain standard interconnectivity. These need also to consider some evolving proposals for scaling Bitcoin or Ethereum networks, called Lightning or Sharding, which basically consist to create state channels or overlap networks to simplify the transaction validation process while building multilayer infrastructure.

Future blockchain networks will then be an inextricable tangle of standards and multilayer protocols. The challenges lie in finding the better compromise between complexity and usability. It requires time for technological improvement before industrialization.

Blockchain applications: Being pragmatic while brushing aside background noise

On the usage aspect, we have seen everything and its opposite since a few years. It is hard to sorting out the real opportunities from the background noise.

Cryptocurrencies: A first-mover advantage supporting a revolutionary ideology

Cryptocurrencies have been the first blockchain use case supported by the cyberpunk ideal to confront with the traditional financial system. In a way, this is a truly interesting movement as it affects one of the most sensitive sectors of our economy, which is also its foundation.

At this time, this movement seems to be intended to achieve the creation of a new reserve digital asset class. Bitcoin is currently considered as the digital gold, and even with all the controversies on carbon impact or energy efficiency, it appears more than likely to succeed in this way. Underlying protocols will evolve with time, and financial lobbies will likely end up adopting this new asset class.

Public networks: From utility to security tokens, including stable coins

Then come other public blockchain platforms delivering smart contract features through different type of tokens. This concern programmable assets, whether it be currencies or other financial instruments. The programmable aspect means to automate a value transfer according to certain conditions. The value in question can represent many different financial vehicles, from utility to security tokens including stable coins.

This last category will eventually replace many current utility tokens. In most cases, the volatility aspects of tokens will be a strong barrier against products or services adoption. On a given use case, a value proposal involving a stable financial vehicle will likely generate a greater adoption than one based on a utility token. Indeed, the automated value exchange featureis sufficiently innovative by itself. On the other hand, the variable value is also an interesting characteristic to promote some specific behaviors, to create network effects, or to share within a given community the value generated by a dedicated product or service. But for most of current tokens that have been generated through ICOs, speculation is too strong compared to real use, distorting the usability.

Within this being said, public blockchain networks have the ability to digitalize every kind of financial vehicle while enjoying the smart contract features. When considering the industry of the future, smart cities, smart energy grids, or advanced transportation systems, these solutions will help fluidized value exchanges from many intelligent devices and systems. In developing synergies with Artificial Intelligence and Internet of Things, public blockchain network is the interconnectivity piece for many innovations.

Private uses: Raising awareness and generating adoption

For this futurist scenario to happen, blockchain technologies must penetrate most companies and industries. This is the major obstacle to blockchain adoption, regarding the high complexity of the technological concept and its different technical implementations. It requires time to sufficiently mature the infrastructure for professionals to be able to use it without having to master the technical complexity. Looking to the current technological developments, several years will be needed.

In the meantime, corporates can explore this new concept by developing private uses: here come the private blockchain networks. The major difference is related to the data types. On public networks, tokens represent the medium of exchange and mainly are a unit value. On private networks, basic data are often exchanged without using any token. Networks scale are usually several orders of magnitude lower and data transferred could be more complex. In some case, the blockchain label is questionable as actors are sometimes developing basic architecture of shared database. Effectively, it remains innovative for companies that have still a lot to do in their digitalization process. This is a first step before to explore further blockchain uses.

The remaining issue is about finding the relevant use cases, which is also important for any public uses. A relevant use cases usually involve two main aspects: the true need for a distributed information system, and the ability to control edge-effects. When the need to exchange information can be led by a single player, a centralized data base is often more efficient. And if there is no way to check the truthfulness of information before to be recorded within the distributed information system, the problematic remains the same even with a blockchain architecture.

Conclusion: From a cyberpunk promise to the next economic digitalization process

To conclude, blockchain technologies are following a similar development scheme than internet technologies 20 years ago. At these times, Internet was also very controversial before to sustain the advent of a global network. The specificity of this new web comes from its origin. Internet has emerged as a military tool, but blockchain technologies has been created as an anti-capitalism solution. Regardless their origin, the development path remains comparable. Where internet bring us information fluidity, blockchain will liquefy value exchanges.

Irrespective of the technical complexity and the controversial uses, the promise behind blockchain technologies is about bringing digitalization process to the next step by provoking a new digital wave on our economic and financial system. Cryptocurrencies doesn’t have to dictate the future for this to happen. They played their role as a Trojan horse to introduce blockchain in major corporations. They probably won’t succeed in their current shape, but they also could inspire future use cases in the coming token economy.