Since the wake of ICOs, people have expressed a lot of strong opinions about its implications on startup funding. At its height, ICO funding was considered the digital disruption of the venture capital industry, with the expectation that it’ll replace VC money anytime soon. Then after pre-sale rounds became more commonplace and some projects even skipped a public sale, the narrative became that institutional investors are taking over, leaving only bread crumbs for the rest of us.

I was curious how the numbers actually look like and if they would support any of the more extreme hypothesis. So I did some research on both ICO and venture funding of blockchain projects to get some insights into crypto funding trends.

CBInsights published some reports in early 2017, mid 2017, and 2018 that merged to get to the venture funding numbers. Their last report only covered data until March 2018, so I added data from index.co for the remaining months until incl. September. For ICO data, I used icodata.io which covers the whole time frame. And for total venture funding data the latest PWC/MoneyTree report.

First, let’s have a look at ICO funding data:

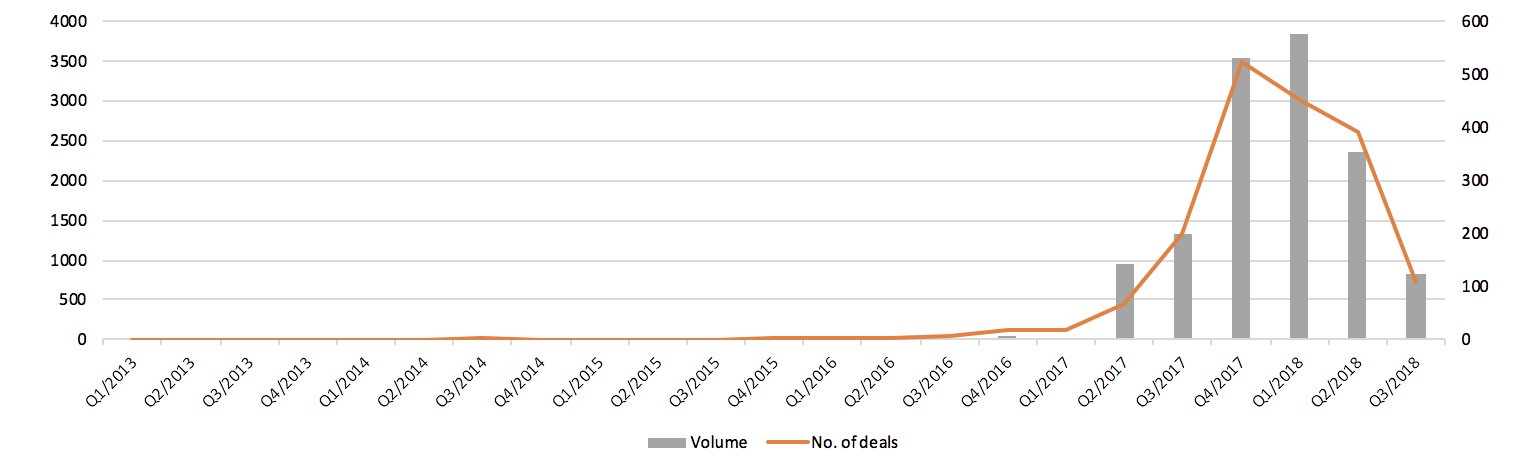

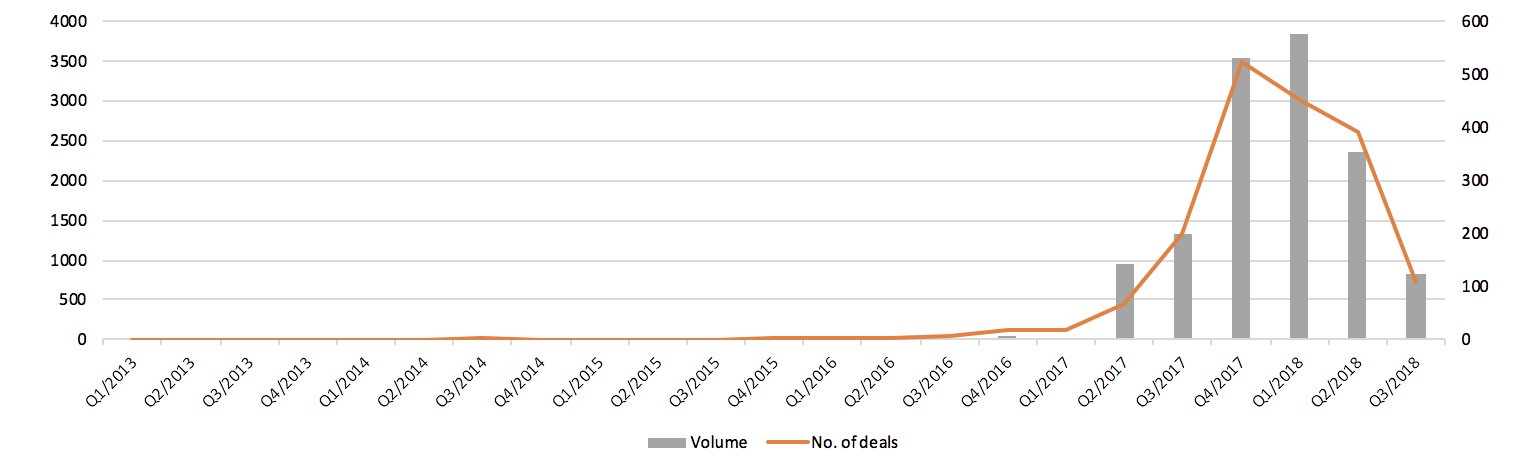

ICO funding by quarter (2013–2018) — Y-axis left: volume in mUSD, right: no. of deals

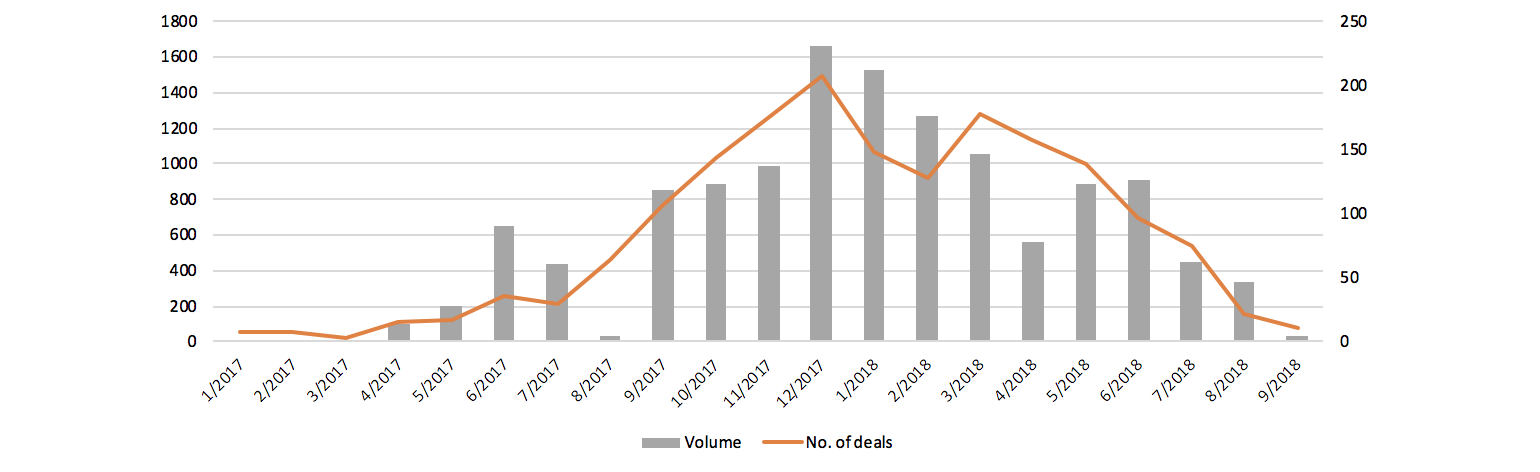

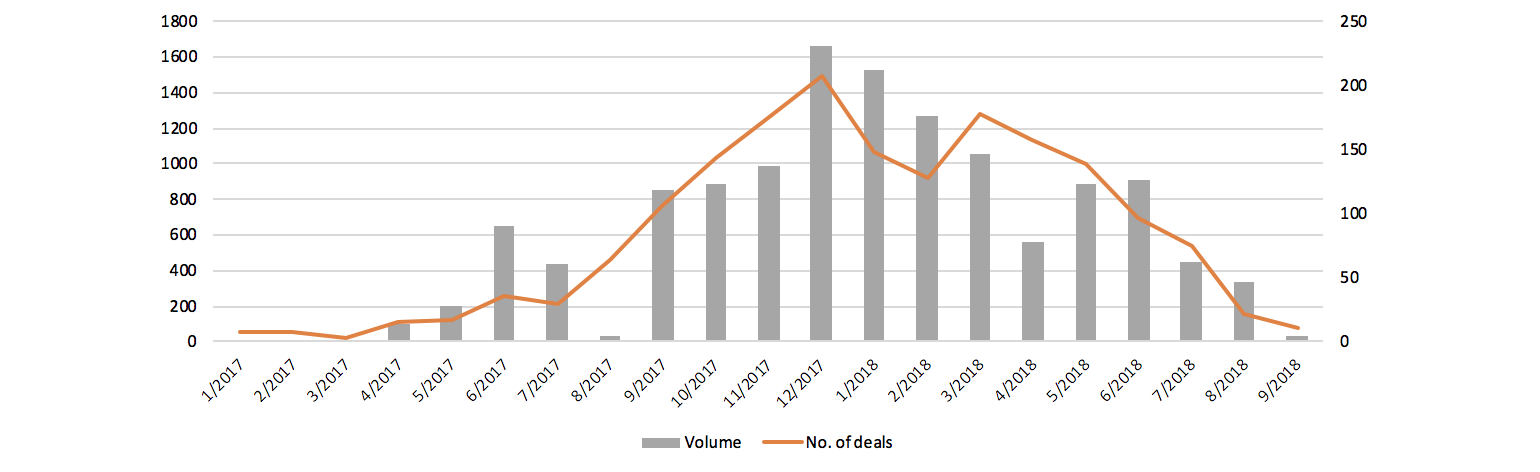

ICO funding by month (2017–2018) — Y-axis left: volume in mUSD, right: no. of deals

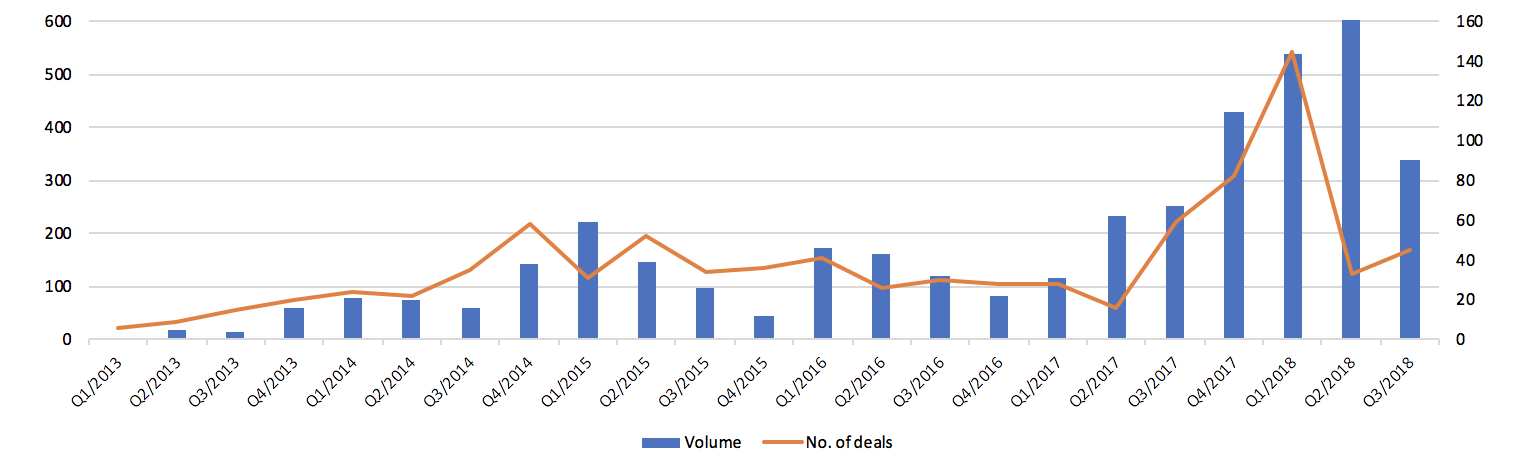

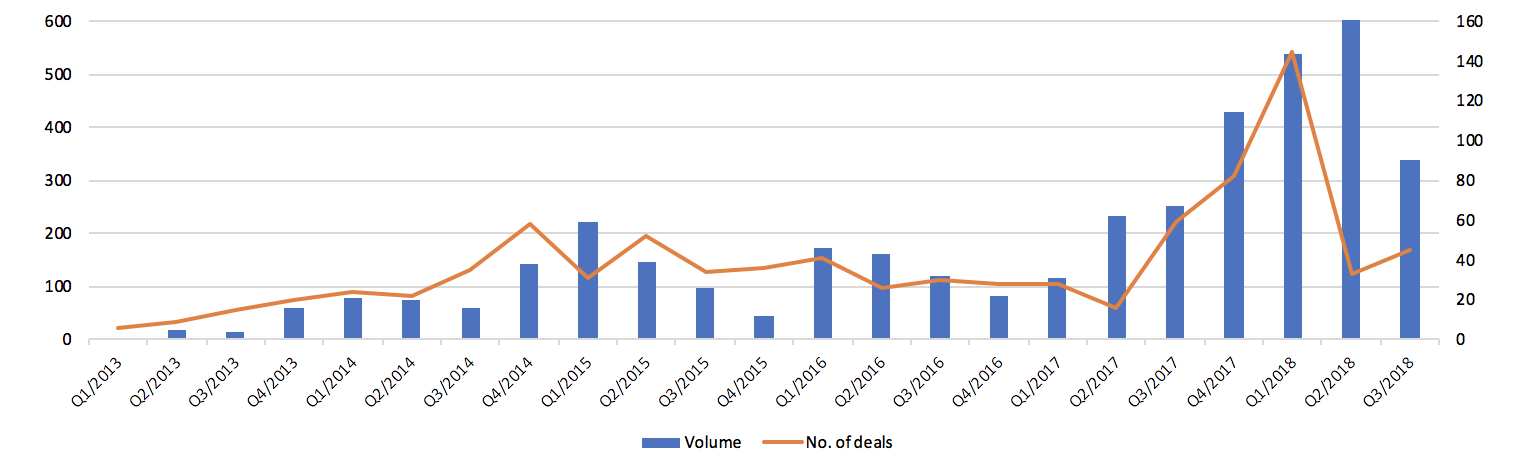

Blockchain venture funding by quarter (2013–2018) — Y-axis left: volume in mUSD, right: no. of deals

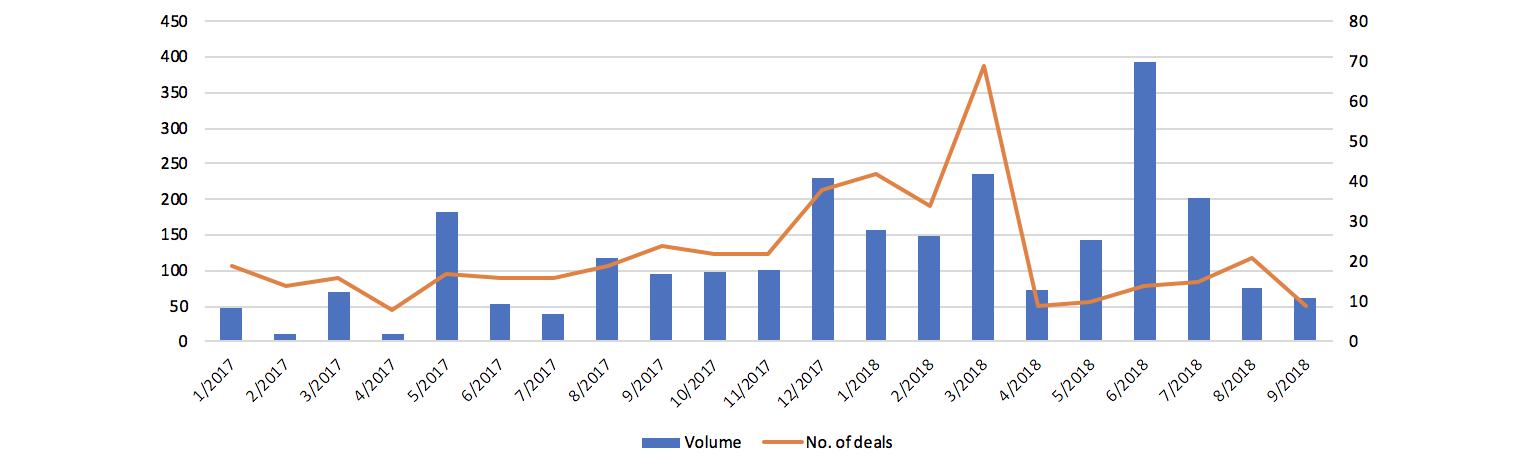

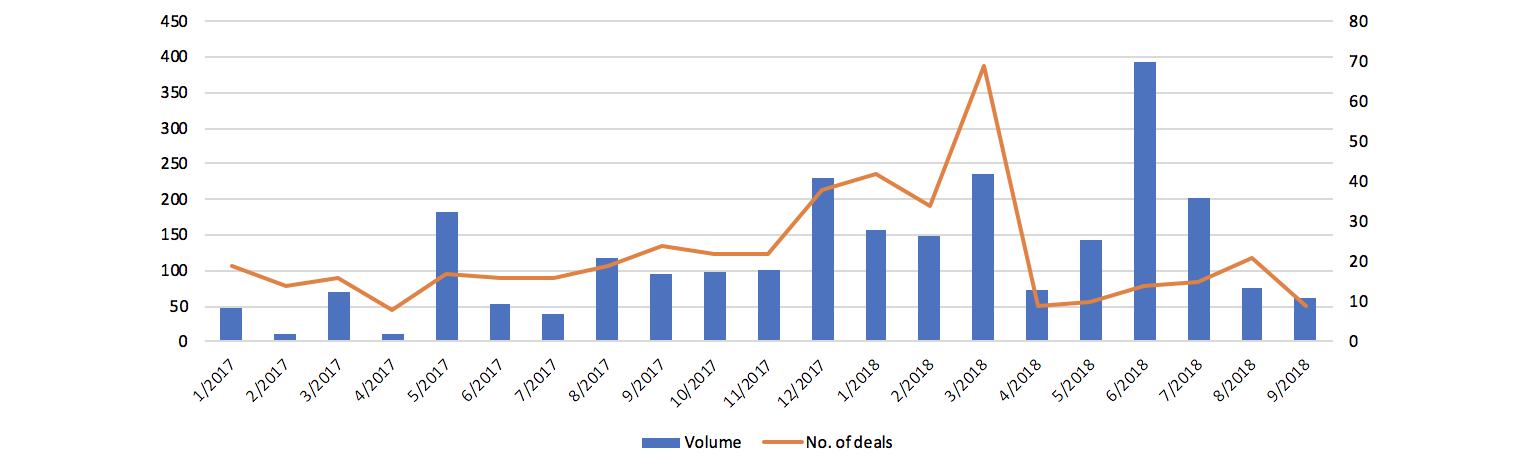

Blockchain venture funding by month (2017–2018) — Y-axis left: volume in mUSD, right: no. of deals

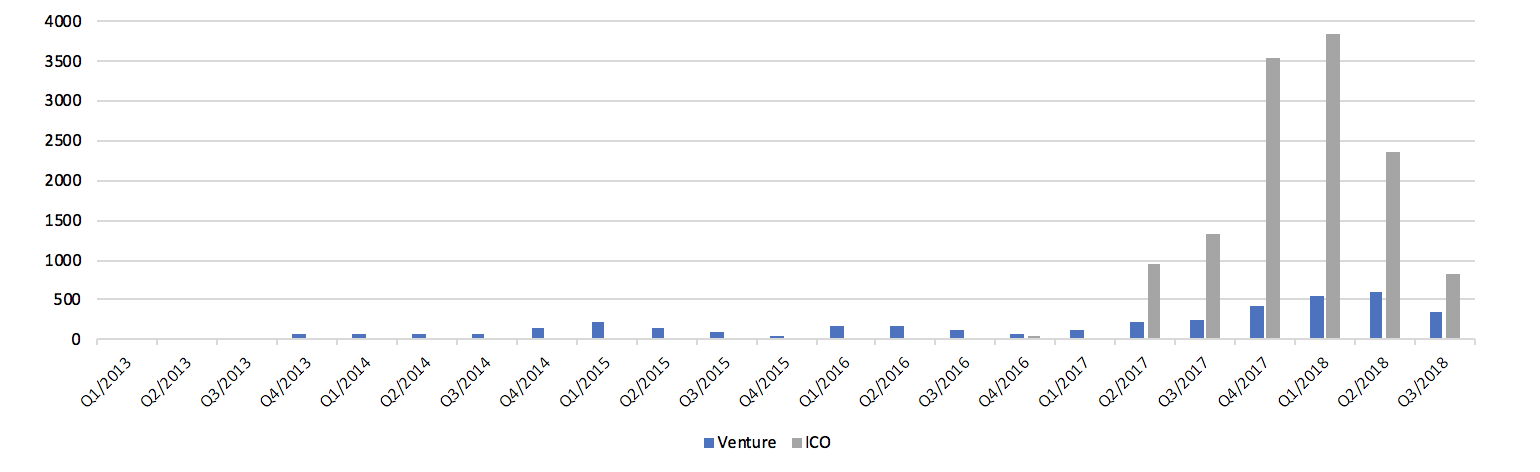

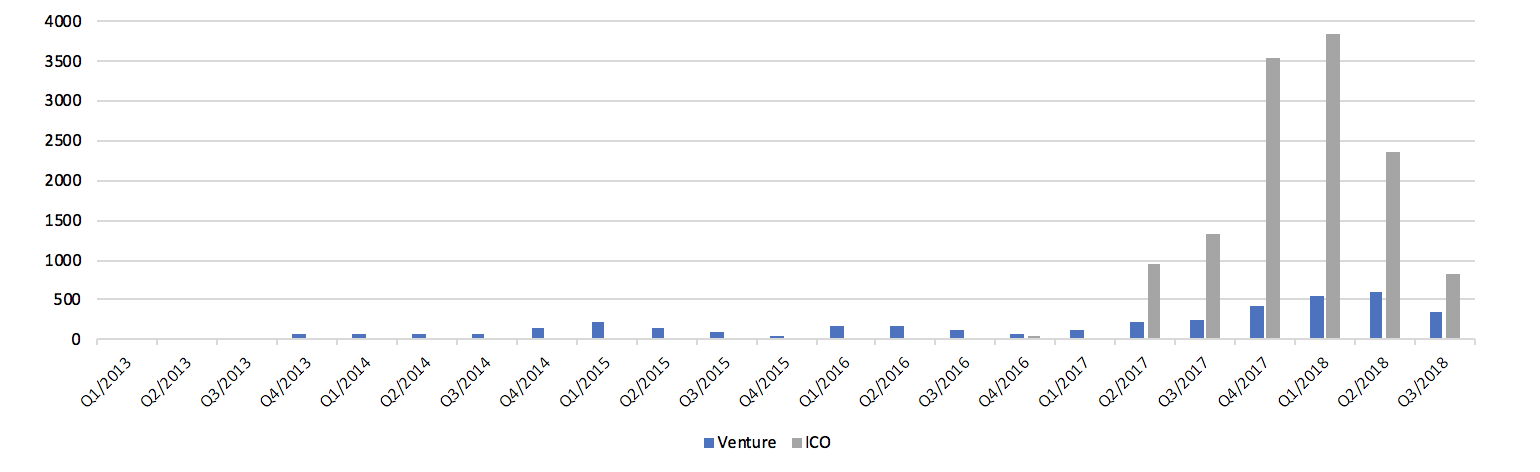

Comparison venture & ICO funding volumes (2013–2018) — Y-axis: volume in mUSD

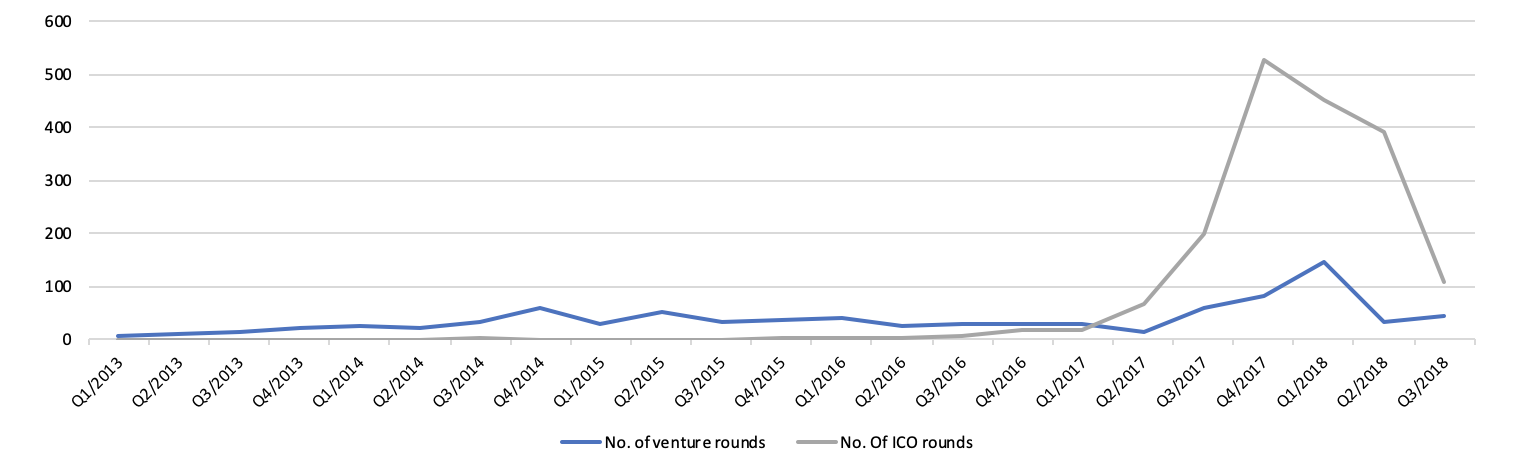

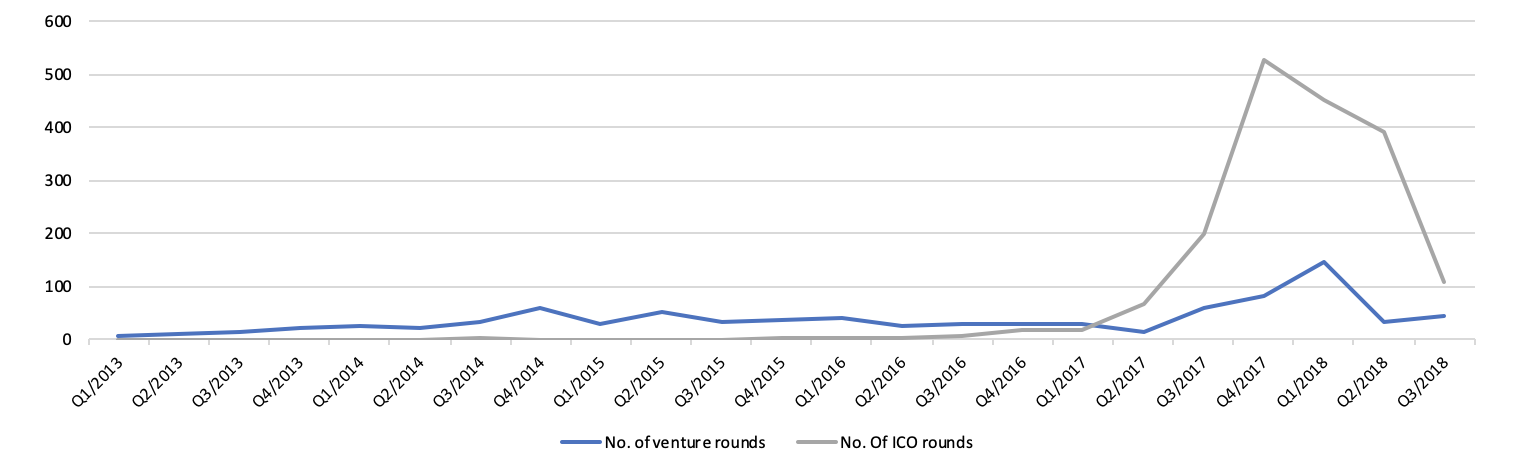

Comparison venture & ICO funding rounds (2013–2018) — Y-axis no. of deals

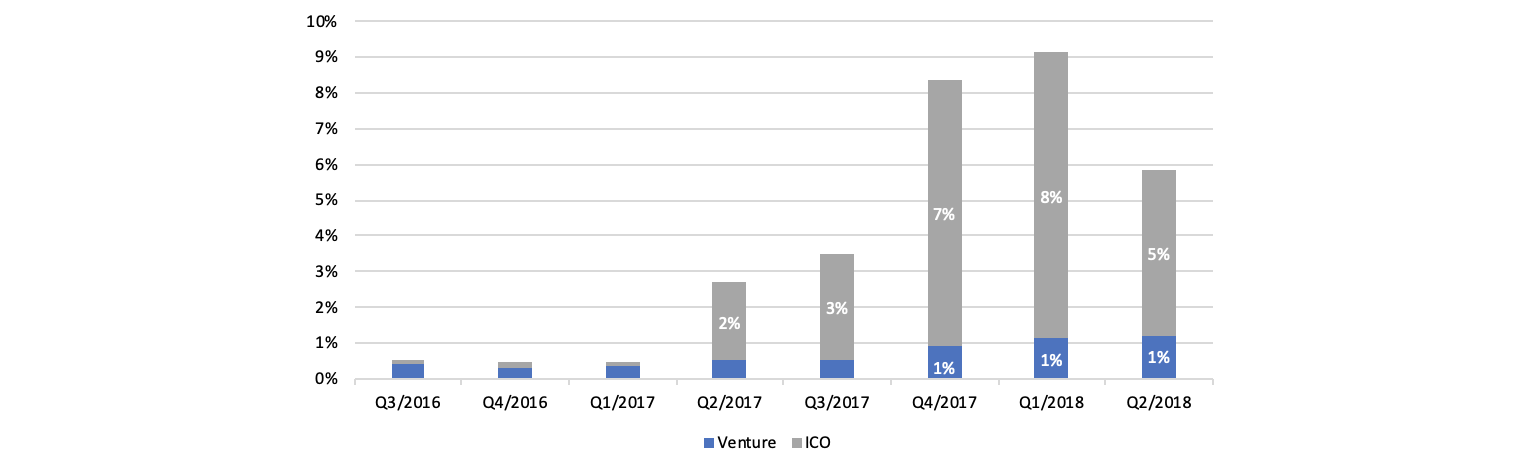

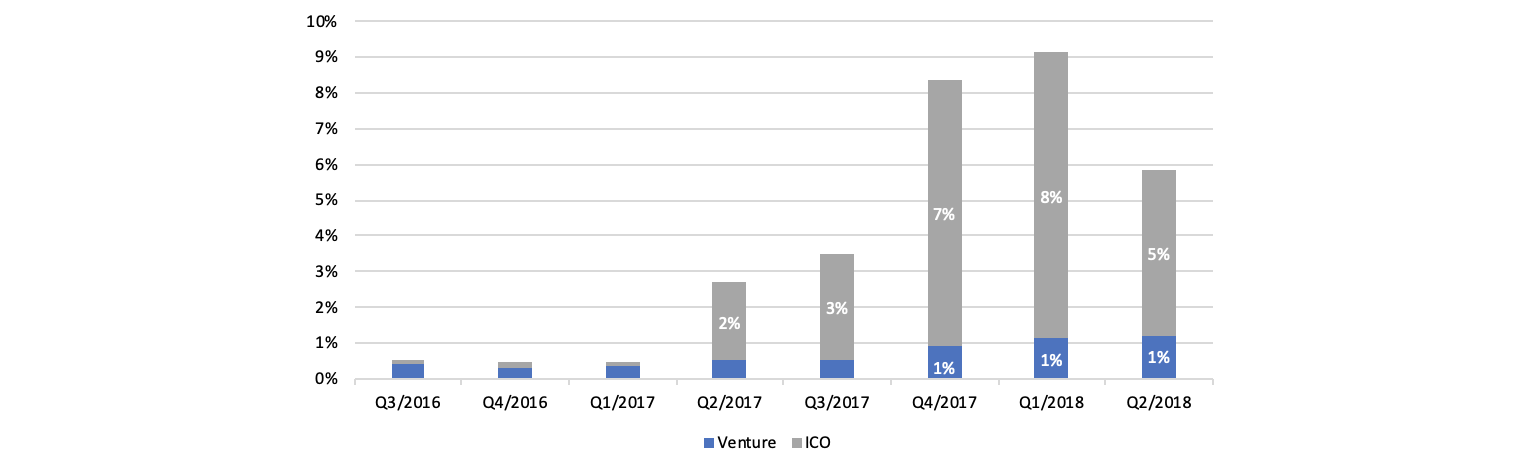

Blockchain funding in % of total venture funding (Q3/2016–Q2/2018)

I was curious how the numbers actually look like and if they would support any of the more extreme hypothesis. So I did some research on both ICO and venture funding of blockchain projects to get some insights into crypto funding trends.

CBInsights published some reports in early 2017, mid 2017, and 2018 that merged to get to the venture funding numbers. Their last report only covered data until March 2018, so I added data from index.co for the remaining months until incl. September. For ICO data, I used icodata.io which covers the whole time frame. And for total venture funding data the latest PWC/MoneyTree report.

First, let’s have a look at ICO funding data:

ICO funding by quarter (2013–2018) — Y-axis left: volume in mUSD, right: no. of deals

- There were only 34 ICO funding deals until the end of 2016, raising a total of 121m, i.e. about 3.5m on average.

- In 2017, the cambrian explosion of crypto projects began and brought us 1.8k ICOs raising a total of 12.9b since then, with 7.1m on average.

ICO funding by month (2017–2018) — Y-axis left: volume in mUSD, right: no. of deals

- Both ICO funding volume and number of ICOs are down since the crypto market started to decline at the beginning of 2018, still way above pre-2017 levels though.

- September was a particular low; probably because many people believe we have reached market bottom and postpone funding activities, or because of summer breaks (like August 2017).

Blockchain venture funding by quarter (2013–2018) — Y-axis left: volume in mUSD, right: no. of deals

- Venture funding into blockchain projects started earlier; until the end of 2016, 460+ deals with a total of 1.5b were made, the average size was similar to ICO funding with 3.2m.

- There still was an increase in the time period from the beginning of 2017 until today with 400+ deals raising a total of 2.5b and an average deal size of 6m.

Blockchain venture funding by month (2017–2018) — Y-axis left: volume in mUSD, right: no. of deals

- Venture funding seems to not be affected by the crypto market declinewith a relatively steady deal flow month-over-month, and increasing.

- The reason for what seems like a decline in number of deals here is probably just because I had to use a different data source starting April.

Comparison venture & ICO funding volumes (2013–2018) — Y-axis: volume in mUSD

Comparison venture & ICO funding rounds (2013–2018) — Y-axis no. of deals

- Venture funding has been around longer, but ICO funding came with instantly higher volumes, more than an 8x multiple at its peak.

- There are a lot more ICO funding rounds than venture funding rounds, with 1.8k vs. 875 the ratio is about 2:1.

Blockchain funding in % of total venture funding (Q3/2016–Q2/2018)

- Put together, funding into blockchain projects collected a significant portion of global venture funding; together it made up for 8% at its peak.

- The traditional venture part is still low though with only ~1%, e.g. AI funding was 4x as much in Q1

- Traditional venture and ICO funding seem to be able to co-exist nicely.

- Venture funding is an attractive option for early stages, not having to worry about all the implications of an ICO.

- For less conventional projects, early stage ICOs are a way get funding that they wouldn’t have been able to get otherwise.

- A venture-funded project can do an ICO as a follow-up funding round, likely after achieving major milestones at a much higher valuation.

- The sector is still on a growth trajectory, and especially venture funding has not declined, but volatility of ICO funding will remain high as long as the market’s volatility remains high as well.

Likes:

Emmyeddy1