Nodes are an indispensable part of blockchain technology. We look at how they work and at the role of masternodes to provide additional services to the network and to provide long-term returns to their owners.

Another day, another revelation (for me) about how blockchain and cryptocurrencies work.

This time it was about nodes — those “distributed” computers that connect to a blockchain’s network and keep it running according to the rules.

I was surprised at how much I’d simply taken them for granted as part of the blockchain world and how I’d assumed that all of them were being rewarded for what they were doing. That was until I heard about masternodes and was trying to understand why they could be an important part of stabilizing blockchain networks.

This article will unpack something about blockchain nodes and consensus algorithms, and then consider the role of masternodes, how to own a masternode and what the benefits and drawbacks are. Finally, we ask the question, “ Is it a good idea to own a masternode?”

Understanding blockchain nodes

Blockchains and cryptocurrencies won’t work without nodes. They download every block, record every transaction in real time, accept only the blocks that have followed the rules of consensus, broadcast new blocks to other nodes and synchronize with all other nodes.

The work of the nodes is regulated by two types of consensus:

· A consensus algorithm, such as proof-of-work or proof-of-stake.

· Internal consensus rules. For example, Bitcoin’s rules include no double-spend, the correct format for blocks and transactions, the amount of BTC reward per block.

The combination of consensus algorithm and consensus rules produces a network that can be trusted, where there is agreement as to the shared state of the blockchain.

The more nodes there are that agree within a network, the more trustless and decentralized the system becomes.

Satoshi Nakamoto envisaged a scenario where “nodes work all at once with little coordination”. They did not need to be identified and they could join and leave the network as they chose. They would be well-rewarded through earning new coins and transaction fees. This would encourage them to remain honest.

What is true about this vision is that the rewards can be very attractive and the competition for them can be fierce. Also true, unfortunately, is that costs and technical difficulties associated with running a full node (one that downloads a full record of the blockchain) are also increasing.

The Satoshi reward scenario applies only to nodes that are also miners. Full non-mining nodes are not financially incentivized, even though they are using memory, storage capacity and electricity to remain connected and to provide a validation service to the network.

There are reasons for non-mining nodes to be part of the network — other than the purely altruistic one of supporting it. For example, exchanges might want to be sure of all the transactions passing through and would want a full record of the blockchains of all of the listed coins. Developers building apps on top of a blockchain would want a full record of both testnet and mainnet activities. Companies wanting to ensure that they are working on a stable and secure network may sponsor nodes.

Purists may argue that it is only “hash rate” — the amount of energy expended by miners — that decides on the direction of a blockchain. Others point to the stabilizing effect of higher numbers of nodes, also to balance the power of miners.

If this second argument has any weight, then it might be necessary to incentivize non-mining nodes.

One of the ways to do so is through masternodes, first introduced by Dash, and now implemented by hundreds of other applications.

Consensus algorithms

The two best-known methods for finding consensus on a blockchain are:

· The Proof-of-Work algorithm (PoW)

· The Proof-of-Stake algorithm (PoS)

1. Proof of work protocol = the puzzle-solving method

Bitcoin and Ethereum (and multiple others) use the proof-of-work protocol. So-called miners use computers to resolve a mathematical problem, using specific sets of rules or algorithms. The first one to solve the problem has his block added to the blockchain and is rewarded with the underlying coin. Other miners stop working on their blocks, start on new ones, and add future blocks to the longest chain.Miners secure the network. The more activity there is, referred to as high hash rate, the more secure the network becomes.

On the downside, this system uses extreme amounts of energy, leading to miners pooling their resources (their hash power) and resorting to very expensive ASIC, CPU or GPU hardware, thus effectively squeezing out smaller players with slower equipment. The cost per transaction also rises. There is concern that very large pools of miners may threaten the decentralized notion of consensus.

2. Proof of stake protocol = validating the contents of a block, by validators who own a stake in the network.

In the proof of stake (PoS) protocol, there are validators rather than miners. Validators own some of the underlying coins of the blockchain and they deposit, or “stake” some of their coins into the network as collateral to vouch for the contents of a block. The creator or “forger” of the block earns transaction fees, and, in some cases, a share in other revenue.“Staking” coins means that you are holding coins in your wallet and keeping your wallet connected to the blockchain network 24/7, in hopes that you will be randomly selected to validate a block and to receive the block reward for it. The chance for being selected increases based on the age and the number of coins you hold. These two factors determine your staked coins weight against the network’s weight. So, for example, someone holding 2,000 coins would have double the chance of being chosen to validate the block, than someone with 1,000 coins. However, the chance of you earning a reward is still random, which is why the time to earn a reward is “expected”, and not guaranteed. The randomization makes sure that the node with the highest holding doesn’t automatically get all the chances.

Staking = retaining coins in a wallet and keeping the wallet connected to the blockchain network 24/7.

People wanting to stake may sometimes decide to add their coins to a pool to increase the number and therefore the chance of securing a block. Companies such as Stake United, Stakinglab and StakeCube facilitate this. Their service keeps wallets updated and coins connected all the time and means that owners do not have to maintain the 24/7 connection.PoS is believed to be superior to PoW because it is less energy-intensive. Also, validators are risking their own coins to participate and are therefore more likely to be honest and not attempt hostile takeovers. However, much of this is unproven, and Vlad Zamfir, who is working on the Casper project to move Ethereum from PoW to PoS has outlined some of the reasons for applying caution.

(Also see our previous article “Casper, Lightning and open-heart surgery — the race for scalability” for an overview of proposed improvements to both Bitcoin and Ethereum protocols.)

However, one of the key concerns about PoS is that there might not be sufficient reward for validators and that individuals and entities will not be encouraged to host nodes.

This is where masternodes may be the answer.

The role of masternodes

In technical terms, masternodes are special network nodes that run wallet software on the blockchain, in order to provide certain services to the network.

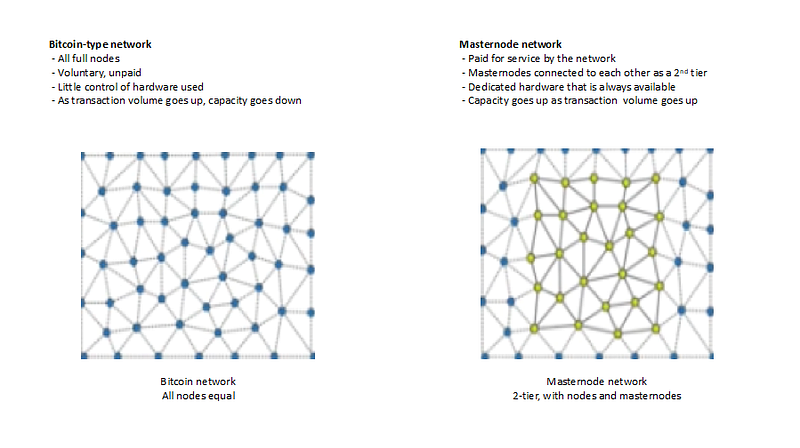

The difference between a Bitcoin-type network with homogeneous nodes competing to mine blocks and a masternode network, where nodes are paid for their services, is illustrated in the following diagram:

Differences between Bitcoin-type and masternode networks

Masternodes form the backbone of the network. They provide resources and deliver services beyond simply relaying blocks and transactions. In return, the owners will receive a significant portion of the rewards available on the network.

Services include the following:

1. Governance:

Someone described masternodes as the “parents” on the network. They provide some structure and order. They have voting rights for management, budget and development decisions. Because there are many people involved in decision-making, the network is more decentralized. The more decentralized a system is, the more secure it becomes. So, the more masternodes there are, the better the security.

Many currencies use a “Foundation” for this governance function, but this is centralized and often disconnected from users.

The governance and voting functions of masternodes also ensure that the network can continue and be updated, even if the initial people lose interest in the project.

2. Privacy and anonymity

Masternodes ensure that the source of your funds remains private. This is done through a series of rounds of “mixing” of coins, known as “PrivateSend”. This is a feature originally introduced by Dash.

3. Instant transactions

The speed of transactions in the masternode model is one of the most important reasons to use it. Most decentralized cryptocurrencies have to wait for enough blocks to pass before there is certainty that the transaction is irreversible and that there is no chance of “double-spend” of the same funds. This can mean a delay of several minutes and longer.

To solve this, the masternodes form off-chain voting groups or quorums that can quickly check on whether a submitted transaction is valid. They then “lock” the transaction, don’t allow any further spending on the inputs, and inform the network that it will be included in a subsequent block.

Again, this is a feature originally introduced by Dash, called InstantSend.

Who can own a masternode?

Masternodes are an alternative to mining. Not everyone has the computing power or technical know-how to mine, but anyone can own a masternode.

Any node can become a masternode, but it requires the owner to deposit a fairly large number of coins. For example, Dash requires that a masternode deposits 1,000 DASH coins. This was affordable when DASH coins were worth less than one USD. Even at the very deflated October 2018 price, this now means $157,000. At the height of the December 2017 boom, a Dash masternode would have required a deposit of $1.5 million.

The owner must also have sufficient computing and server capacity to host the full transaction history of the currency — ie it must be a full node and must continue to run 24/7.

These coins are not locked for a predetermined period of time. They remain in the owner’s wallet and can be spent or sold at any time. If this happens, however, the masternode status is removed from the node.

Because the coins must remain in the wallets, they remain in the network and stabilize it. In addition, while they are removed from circulation they create scarcity. This tends to drive up the value of a coin.

Masternodes can be used to attract investors, and this too can lead to appreciation in the value of the coin.

Masternodes = special network nodes that run wallet software on the blockchain and provide certain services to the network.

The benefits and drawbacks of owning a masternodeMasternodes are allocated a portion of the reward for each new block even if they did not create it. Every coin has its own allocation, but the original Dash model shared out the forged coin as follows:

· 45% to the validator

· 45% to the masternode

· 10% to the treasury fund (to maintain the network and make further improvements)

According to the Dash website a masternode can typically expect to be paid about 2 DASH every 7 days.

In addition, masternodes are paid a transaction fee every time a user makes use of a service such as InstantSend or PrivateSend. And, of course, they can also participate in the normal staking process and earn 45% of any coin that they have forged.

The wallets on the nodes can be thought of as savings accounts. Income can be regarded as interest on an investment and as a way to create passive income. Once the technology has been set up, it continues to generate income on a daily basis. Various sites, such as Masternodes.online and YearTo.Datemonitor these returns and provide an indication of ROI.

Currently, Masternodes.online is showing over 500 masternode coins, with a valuation of just under a billion USD. Dash has more than 50% dominance and has nearly 7% ROI (annual return on investment). If this is correct, it is a fairly encouraging figure, given the “meltdown” in all crypto prices in 2018. Typical ROI’s at the beginning of 2018 ran into hundreds or even thousands of percentage points.

The downside of owning a masternode is that the value fluctuates with the value of the cryptocurrency — and this has been particularly unkind during 2018. According to YearTo.Date, even the third-best performing coin of the year is in the red. However, this should be balanced by the view that masternodes are designed to encourage long-term investment. Owners of masternodes are encouraged to “hodl” their investments and wait for returns over the years.

Is it a good idea to own a masternode?

There’s no question that owning a masternode in the right network can deliver good returns. However, choosing the correct network may not be that easy. A pump and dump scheme will have your investment vanish into the ether.

Probably the most sensible advice is in the disclaimer on the Masternodes.online site: